Bookkeepers Near Me: Find Skilled Accounting Professionals In Your Local Area For Expert Financial Management

Significance of Local Financial Management Services in Your Community

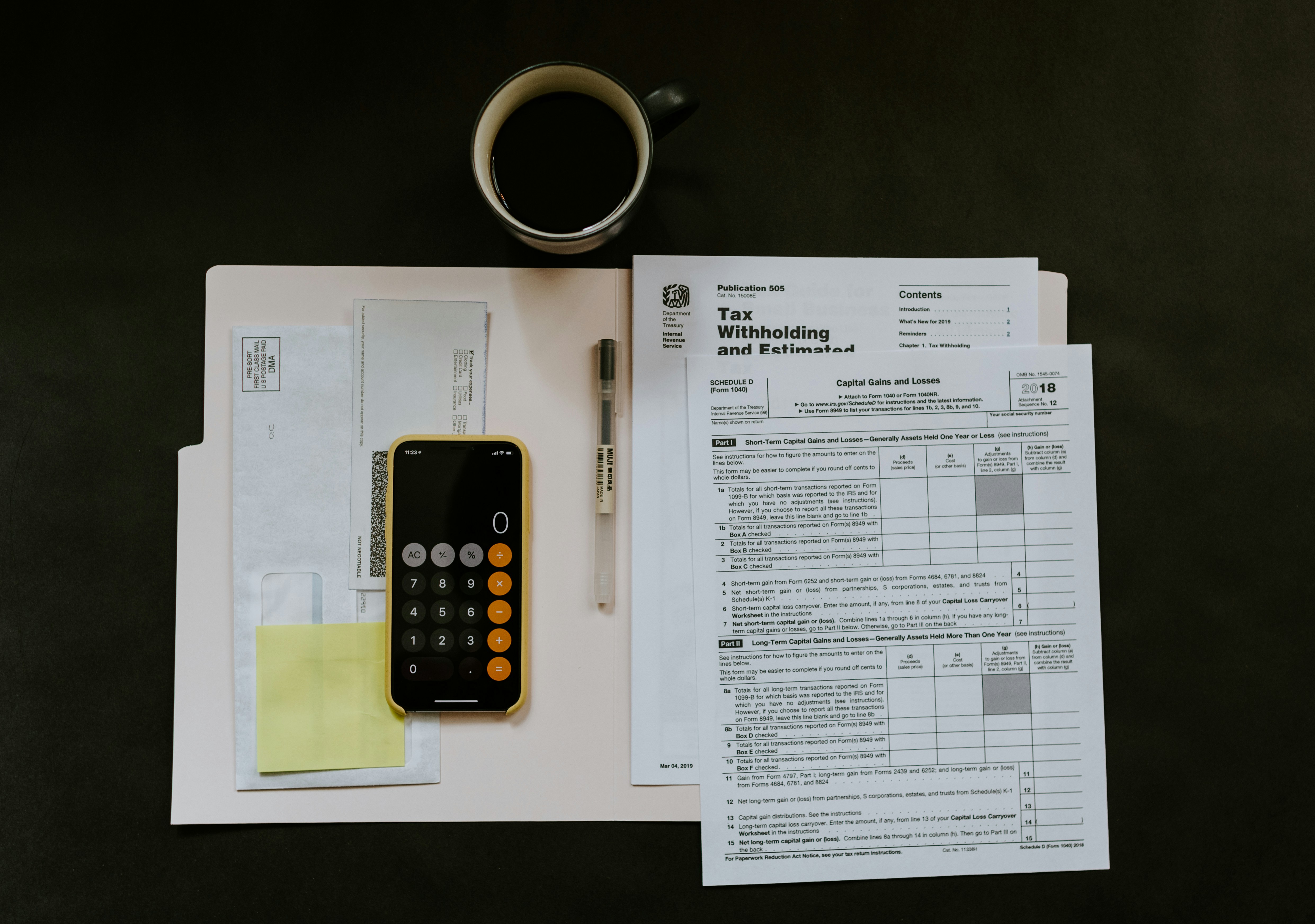

Many individuals and enterprises encounter challenges when it comes to managing their financial records. The complexity of taxes, regulations, and bookkeeping practices can be daunting. Without the right expertise, the risk of errors increases, leading to potential financial repercussions. Local financial professionals understand the unique needs of the community, providing tailored solutions that are often overlooked by larger, distant firms.

- Inaccurate entries and mismanaged accounts can lead to significant stress.

- Understanding local tax laws and compliance standards is crucial.

- Finding reliable assistance nearby can feel overwhelming.

However, engaging with a dedicated local firm like Bookkeeping Services USA transforms the experience. They excel in alleviating these concerns and more!

- Personalized attention to your financial landscape.

- Expertise in local regulations ensures compliance.

- Timely reporting and accurate tracking of your finances.

- Proactive communication keeps you informed and prepared.

The convenience of having skilled financial professionals within reach not only simplifies your bookkeeping tasks but also enhances your overall financial health. Say goodbye to confusion and hello to clarity with the assistance of seasoned experts who prioritize your success! No more endless searching for the right people; the solution is right at your doorstep!

Bookkeeping Sevices USA,2191 Maple St, Wantagh, NY 11793, United States,+15168084834For more information - Click Here

Key Responsibilities of a Professional Bookkeeper in the USA

Maintaining accurate financial records is crucial for any enterprise. Professional bookkeepers are tasked with ensuring that every transaction is meticulously documented. This includes tracking income, expenses, and other financial activities.

One essential aspect involves reconciling bank statements to confirm that the records align with actual bank balances. This process not only prevents discrepancies but also aids in identifying potential errors before they escalate.

- Recording daily transactions with precision

- Organizing financial documents for easy access

- Generating timely financial reports to inform decision-making

- Monitoring cash flow to maintain operational efficiency

Bookkeeping Services USA excels in these areas, providing tailored solutions that cater to the unique demands of local businesses. They employ advanced software tools, enhancing the accuracy and speed of data management.

Another pivotal responsibility is managing payroll, which ensures employees are compensated correctly and on time. This includes calculating wages, withholding taxes, and ensuring compliance with labor regulations. Understanding these nuances is vital for maintaining a motivated workforce.

Expert Tips for Effective Bookkeeping

- Utilize cloud-based solutions for real-time access to financial data.

- Regularly update and back up financial information to prevent loss.

- Establish a consistent filing system to keep documents organized.

- Review financial reports monthly to track progress and adjust strategies.

With a keen eye for detail, Bookkeeping Services USA not only manages the numbers but also provides insights that can drive business growth. Their expertise ensures that financial health is maintained, allowing business owners to focus on what they do best.

Advantages of Engaging Bookkeeping Services in the USA

Managing finances can often feel overwhelming, particularly when it comes to keeping track of receipts, invoices, and various financial documents. This can lead to a disorganized financial landscape that complicates tax preparation and year-end assessments. However, opting for professional bookkeeping services offers a straightforward solution.

Bookkeeping Services USA excels in alleviating this burden by meticulously handling all financial records. Their experienced team is adept at transforming chaos into clarity, ensuring that every penny is accounted for. With their expertise, business owners can focus more on growth and less on numbers.

- Consistent financial tracking, which enhances decision-making.

- Timely reporting, providing insights into cash flow and expenditure.

- Expertise in tax regulations, minimizing the risk of costly errors.

- Customized financial strategies to meet specific business needs.

One of the standout features of Bookkeeping Services USA is their proactive approach. They don't merely react to financial discrepancies; they anticipate them. This foresight allows businesses to pivot quickly in response to market shifts.

Pro Tips for Effective Financial Management

- Regularly reconcile bank statements to identify discrepancies early.

- Implement a cloud-based accounting system for real-time access.

- Schedule quarterly financial reviews to stay ahead of trends.

By leveraging the expertise of Bookkeeping Services USA, entrepreneurs not only simplify their financial responsibilities but also gain a strategic partner in navigating the complexities of business finance. Their dedicated service ensures that financial records are not just maintained but optimized for future success.

Choosing the Ideal Accountant in the USA

Finding the right financial steward can significantly influence the trajectory of your enterprise. An adept bookkeeper is not merely a number cruncher; they are pivotal in maintaining fiscal harmony and ensuring your financial documents are immaculate. When searching for an adept professional, consider their expertise in various accounting software, as this can streamline your operations and enhance reporting accuracy.

Key Qualities to Seek

- Attention to Detail: Precision is paramount. A meticulous bookkeeper will catch discrepancies before they evolve into larger issues.

- Industry Knowledge: Familiarity with your sector can provide insights that generic accountants may overlook.

- Communication Skills: A proficient bookkeeper articulates complex financial information clearly, making it accessible to you.

- Technological Proficiency: Staying updated with the latest tools enhances efficiency and accuracy.

Consider Your Unique Needs

Reflect on the specific requirements of your business. Do you need assistance with payroll, tax preparation, or financial reporting? Understanding your distinct needs will guide you in selecting a professional who aligns with your goals. Bookkeeping Services USA excels in offering tailored solutions that cater to the individual demands of your organization.

Practical Tips for Selection

- Review their qualifications and certifications.

- Inquire about their experience with businesses of your size.

- Ask for case studies or examples of previous work.

- Evaluate their responsiveness and willingness to collaborate.

Engaging with a competent bookkeeping service can result in streamlined processes and informed decision-making. Bookkeeping Services USA stands ready to assist with a suite of services designed to elevate your financial management. Their expertise can transform your accounting experience, allowing you to focus on growth and innovation in your business.

Common Bookkeeping Practices for Small Enterprises in the USA

Maintaining a proper financial ledger is paramount for any emerging venture. Disorganization can lead to a cascade of discrepancies, which may complicate tax filings and financial analysis. Regularly tracking expenses and income ensures a solid grasp on the financial pulse of the business. Utilizing digital tools simplifies this process, enabling real-time updates and reporting.

Essential Practices to Incorporate

- Consistent categorization of transactions aids in clarity and simplifies reporting.

- Monthly reconciliations between bank statements and internal records prevent potential errors.

- Implementing a robust invoicing system expedites cash flow, reducing the lag in receivables.

- Staying informed about tax obligations enhances compliance and avoids unexpected liabilities.

Bookkeeping Services USA excels at transforming these practices into streamlined routines for small businesses. They've honed their expertise to ensure that your financial operations are not just maintained but optimized. Their adept team focuses on meticulous record-keeping while providing insights that help businesses thrive.

Advanced Tips for Effective Bookkeeping

- Utilize cloud-based accounting software for accessibility and collaboration.

- Set aside time each week dedicated solely to reviewing financial statements.

- Educate staff on basic bookkeeping principles to foster a culture of financial awareness.

- Regularly assess financial health using key performance indicators (KPIs) to inform strategic decisions.

With the right tools and support, small businesses can navigate the intricate world of finances more confidently. Bookkeeping Services USA is committed to guiding you through this landscape, ensuring that financial clarity is always within reach.

Essential Tools and Software Used by Local Bookkeepers in the USA

The landscape of financial management is constantly evolving, and having the right instruments is vital for proficient record-keeping. Local professionals employ a variety of software solutions to ensure precision and efficiency in their tasks. A few indispensable tools that are commonly utilized include:

- Accounting platforms for streamlined ledger management

- Spreadsheet applications for data organization and analysis

- Invoice generation software to enhance billing processes

- Document management systems for efficient record retention

- Bank reconciliation tools to maintain financial accuracy

Understanding the myriad of options available can be overwhelming. However, experts in the field, such as Bookkeeping Services USA, recognize the importance of selecting the right software tailored to specific needs. They often recommend integrating tools that synchronize seamlessly, reducing manual entry and the risk of errors.

Key Features to Look for in Bookkeeping Software

When selecting the ideal accounting software, consider these essential features:

- User-friendly interface to ensure quick adaptation

- Customization options for unique business requirements

- Real-time reporting capabilities for informed decision-making

- Integration with banking institutions for smooth transactions

- Robust security measures to protect sensitive financial data

Utilizing these tools effectively can drastically improve productivity and deliver a more organized financial overview. Bookkeeping Services USA excels in leveraging technology to not only simplify processes but also to empower their clients with valuable insights into their financial health.

Understanding Tax Compliance and Financial Reporting in the USA

Managing fiscal responsibilities can often feel like navigating a labyrinth. Tax regulations and financial statements demand a meticulous approach, where even the slightest oversight can lead to significant repercussions. For business proprietors, grappling with these intricacies without expert assistance can be overwhelming.

Bookkeeping Services USA excels in this domain, adeptly guiding clients through the maze of compliance and reporting. Their expertise ensures that your financial records are not just accurate but tailored to meet the unique requirements of your specific industry. They are well-versed in the nuances of local regulations and provide a comprehensive suite of services designed to keep your operations in line with federal and state mandates.

Essential Tips for Effective Financial Management

- Maintain organized records: Regularly update your financial documents to prevent last-minute scrambles during tax season.

- Understand deductible expenses: Familiarize yourself with what qualifies as deductions to maximize your potential tax savings.

- Review financial statements monthly: This practice helps identify any discrepancies early, providing an opportunity to rectify issues before they escalate.

- Stay informed about tax law changes: Regularly monitor updates, as tax codes can shift, impacting your obligations and strategies.

Utilizing advanced technologies, Bookkeeping Services USA integrates software solutions that streamline data entry and enhance accuracy. Their skilled professionals are proficient in interpreting complex financial data, allowing you to focus on strategic growth rather than getting bogged down in the minutiae.

Key Components of Financial Reporting

- Balance Sheet: Offers a snapshot of assets, liabilities, and equity at a given moment.

- Income Statement: Summarizes revenues and expenses over a specified period, illuminating profitability.

- Cash Flow Statement: Tracks the inflow and outflow of cash, critical for assessing liquidity.

- Statement of Changes in Equity: Details changes in ownership interest, providing insights into retained earnings and distributions.

With Bookkeeping Services USA, businesses can navigate the complexities of financial reporting and tax compliance with confidence. Their commitment to accuracy and thoroughness not only alleviates the burden but fosters a robust foundation for future growth.

As a satisfied customer of Bookkeeping Services USA, I can't recommend them enough for anyone looking for reliable bookkeeping solutions. Their expertise and personalized service have truly made a difference for my business. If you're searching for “bookkeepers near me,” I highly encourage you to reach out to them for a free consultation. Their knowledgeable team is ready to provide you with the best advice tailored to your needs. Don't hesitate-contact Bookkeeping Services USA today and take the first step toward financial clarity!